|

by Glenn C. Koenig, webmaster for Town Wide Mall

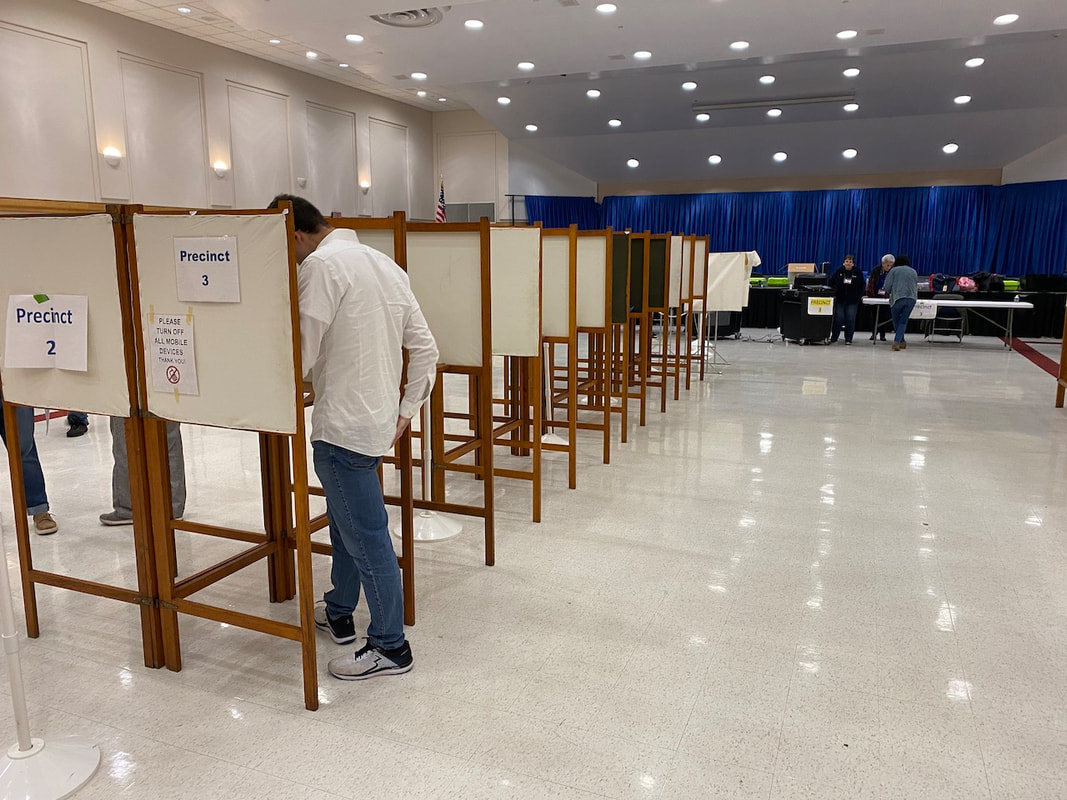

The vote does two things. First, it authorizes the town to borrow the money by selling bonds on the bond market (known as a "bond issue"), in order to raise the funds to build the school as soon as possible. Second, it approves the paying back of the bonds, with interest, over the next 30 years by increasing property taxes above the normal 2.5% annual tax increase limit, as imposed on cities and towns by state law. This is known as a "debt exclusion" because this tax increase is "excluded" from the normal annual tax limit, allowing taxes to be raised more than the usual amount. Only certain types of expenses., such as the incurring of debt to build buildings, can qualify for such over-limit tax increases, under state law. Each such exclusion must be approved by voters in a general election before it can take effect. Comment Although this measure is now approved, there are many steps ahead in completing the design, getting the proper permits, and working out other details before construction can actually start. I encourage everyone to keep an eye out for updates, additional information, and future meetings, in order to stay on top of the process, as much as possible. Democracy does not end at the ballot box, it is an ongoing process where citizens and goverment must work together to achieve the best outcomes.

I will do my best to provide occasional updates in this news feed, here on Town Wide Mall.

1 Comment

mary rosenfeld

11/14/2023 03:03:10 pm

Glenn, I learn more about Maynard, in the most clear and easily understood manner, than I ever do about my own town!

Reply

Leave a Reply. |

AuthorWrite something about yourself. No need to be fancy, just an overview. Archives

June 2024

Categories |

RSS Feed

RSS Feed